3 steps to Self Assessment success

It is just 3 weeks to go until the Self Assessment deadline so if you haven’t already got your tax return sorted, now is the time. Under current tax rules, if you run your own business and are registered self-employed you may need to submit a tax return online, along with other people who are required to file returns such as those whose annual income is over £100,000 per year, who have Capital Gains Tax to pay, who live abroad or who are trustees. The deadline for filing online is Tuesday 31st January and there are fines to pay for every single day that you file late – however good your excuse is!

For some of you this might be an easy task. Your accountants may already have everything in hand, you may have already set the money aside to pay the tax owed and you are simply waiting to press the ‘go’ button. For others this might be the first time you have had to do it – or the annual panic.

If you fall into either of these groups, here are our 3 steps to getting your tax return sorted:

- Don’t delay. Yes there are still 2 weeks to go but that time will soon disappear. There are no fines for filing early! The sooner you start getting the information you need together, the sooner you can start making progress towards filing your return and address any issues that you come across.

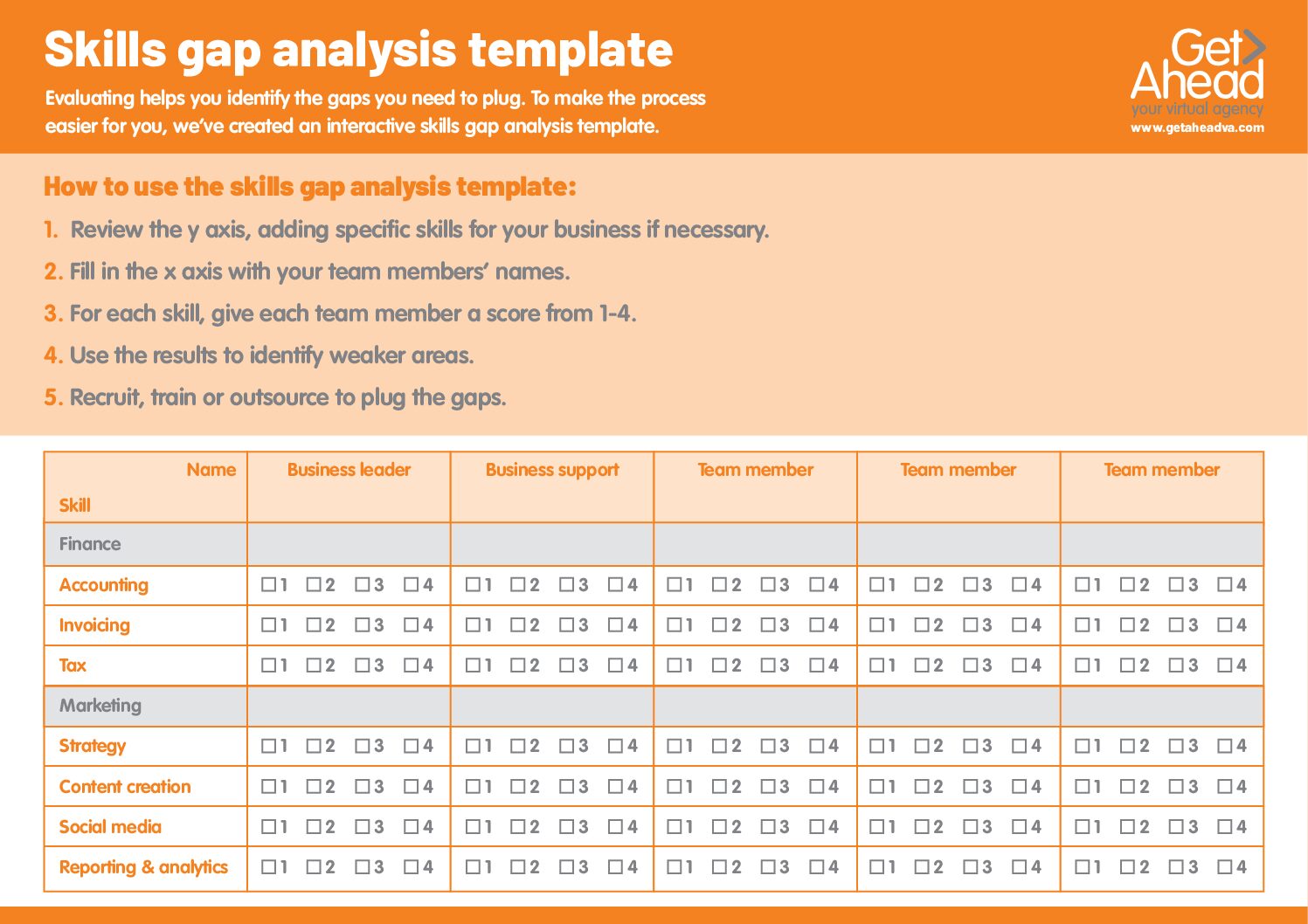

- Tackle that pile of paperwork. You (or your accountant) need to ensure that for the tax year 6 April 2015 to 5 April 2016 you have details ready of your income from all sources as well as details of business expenses, pension contributions and any charitable donations. Time to sort out those receipts and categorise all income and expenditure accordingly.

- Get someone to check your draft return. This may be your accountant or simply a family member or colleague. Another pair of eyes can not only pick up errors but also give you that reassurance to press the submit button. Also check back on previous years to see that the numbers either correlate or vary as you would expect. Ensure you explain any differences so that HMRC understand. Whilst you live your business day to day they do not, and changes in income or profit might seem strange without all the background information.

When you are running your own business, completing things like your tax return can seem like another headache – another task that you don’t have time for. If that is the case then our team of highly experienced virtual assistants are here to help. Our Bookkeeper VA Kathleen can assist you in filing your return and our Administration VAs can help sort out the necessary paper work, allowing you to get back to what you do best – running your business.

Please get in touch on 01483 332220 or email us at office@getaheadva.com to find out more about our nationwide virtual assistance service.

We pride ourselves on being the staff you don’t see, but the difference you do.